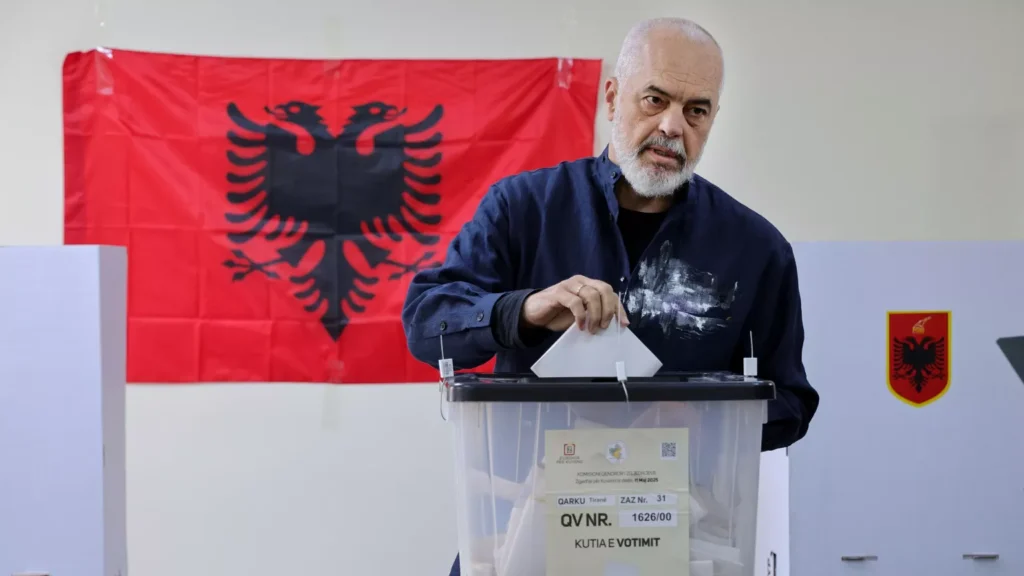

A Pivotal Election for Albania’s Future

On May 11, 2025, Albania held parliamentary elections that could significantly shape its political landscape. Prime Minister Edi Rama, leader of the Socialist Party, is vying for an unprecedented fourth term. His campaign centres on advancing Albania’s European Union (EU) accession ambitions, aiming for membership by 2030. However, the election is also marked by public concerns over corruption and political stagnation, factors that may influence voter turnout and party support.

Rama’s Vision: EU Membership by 2030

Prime Minister Rama has positioned the EU membership goal as a cornerstone of his campaign. He argues that securing a fourth term will enable his government to finalize reforms necessary for EU integration. These reforms include enhancing the rule of law, combating corruption, and improving judicial independence. Rama’s administration has made progress in these areas, but challenges remain, particularly in addressing systemic corruption and strengthening democratic institutions.

Opposition’s Stance and Electoral Dynamics

The main opposition party, the Democratic Party, led by former Prime Minister Sali Berisha, has criticized Rama’s governance, citing ongoing corruption scandals and unmet promises. Berisha’s party advocates for a more stringent approach to EU accession, emphasizing the need for accelerated reforms and greater accountability. The political contest is further complicated by the presence of smaller parties and independent candidates, which could influence the overall electoral outcome and the formation of a governing coalition.

Public Sentiment and Voter Concerns

Albanian voters express a mix of hope and scepticism regarding the future. While there is support for EU integration, many citizens are disillusioned by persistent issues such as unemployment, emigration, and economic inequality. These concerns have led to increased political engagement among the youth and calls for a more transparent and responsive government. The election results will likely reflect the public’s desire for change and accountability.

International Perspective and EU Expectations

The European Union closely monitors Albania’s electoral process, viewing it as a critical indicator of the country’s commitment to democratic principles and reform. EU officials have noted Albania’s progress but stress the importance of continued efforts to meet accession criteria. The outcome of this election will be pivotal in determining Albania’s trajectory toward EU membership and its standing in the broader Western Balkans region.

Conclusion: A Defining Moment for Albania

The May 11 elections represent a defining moment for Albania. Prime Minister Rama’s quest for a fourth term underscores his commitment to EU integration, yet the electorate’s response will hinge on the government’s ability to address longstanding issues of corruption and governance. As ballots are cast and counted, Albania stands at a crossroads, with its future direction poised to be shaped by the choices made at the polls.

Leave a Reply