A Strategic Blockchain Partnership

In a significant development in the world of cryptocurrency, Pakistan has entered into a partnership with World Liberty Financial (WLF), a decentralized finance (DeFi) firm in which the Trump family holds a 60% stake. This collaboration aims to advance block chain technology, stable coin adoption, and DeFi integration across Pakistan. The agreement was formalized through a Letter of Intent signed by WLF representatives and the Pakistan Crypto Council, with the presence of key Pakistani officials, including Prime Minister Shehbaz Sharif and Finance Minister Muhammad Aurangzeb. The partnership is seen as a step toward positioning Pakistan as a leader in the digital finance sector in South Asia.

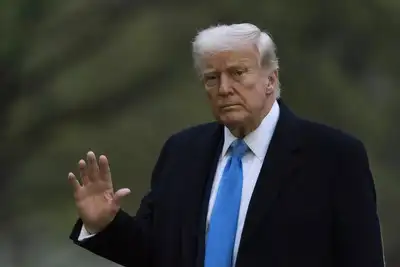

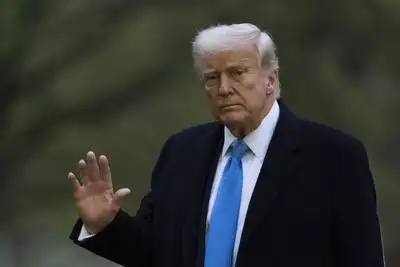

World Liberty Financial: A Trump Family Enterprise

World Liberty Financial, established in 2024, is a DeFi platform backed by the Trump family. The firm’s founders, including Zachary Folkman, Chase Herro, and Zachary Witkoff, have close ties to former U.S. President Donald Trump. The company has been involved in various cryptocurrency ventures, including the launch of the $TRUMP coin, which has raised ethical concerns due to its potential to influence political decisions. Critics argue that such ventures blur the lines between private enterprise and government policy, leading to conflicts of interest and concerns about foreign influence in U.S. politics.

Pakistan’s Ambitious Crypto Goals

Pakistan’s engagement with WLF is part of its broader strategy to enhance its position in the global cryptocurrency market. The country has seen significant growth in crypto adoption, ranking ninth worldwide with approximately 25 million users and $300 billion in annual transactions. The Pakistan Crypto Council, with support from WLF and Binance founder Changpeng Zhao, aims to transform Pakistan into a crypto hub in South Asia, offering a more open regulatory environment compared to neighbouring countries like India. This approach is intended to attract international investment and foster innovation in the digital finance sector.

Ethical and Security Concerns

The timing of the partnership has raised concerns, particularly in India, following a terrorist attack in Pahalgam that resulted in the deaths of 26 people. India has alleged that two of the attackers were from Pakistan, a claim that Pakistan denies. Indian officials have expressed apprehension that cost-effective crypto exchanges in Pakistan could lead to a shift in trading activity, potentially compromising national security if Indian financial data falls into Pakistani hands. Furthermore, the involvement of the Trump family in a Pakistani crypto venture has sparked debates about the ethical implications of such business dealings, especially given the family’s political connections and influence.

Implications for Regional Dynamics

The collaboration between WLF and Pakistan has the potential to impact regional dynamics, particularly in the context of India-Pakistan relations. The integration of block chain technology and digital finance could serve as a new avenue for economic engagement, but it also raises questions about the use of digital platforms for illicit activities, such as tax evasion and money laundering. The partnership may also influence the geopolitical landscape, as countries in the region assess the implications of Pakistan’s move toward embracing digital finance and its association with a prominent U.S. political family.

Looking Ahead

As Pakistan moves forward with its digital finance initiatives, the success of its partnership with World Liberty Financial will depend on the effective implementation of block chain technology and the establishment of a robust regulatory framework. The collaboration has the potential to drive economic growth and innovation in Pakistan’s financial sector. However, it also necessitates careful consideration of ethical standards, security measures, and the broader geopolitical context to ensure that the benefits of digital finance are realized without compromising national interests or regional stability.

Leave a Reply