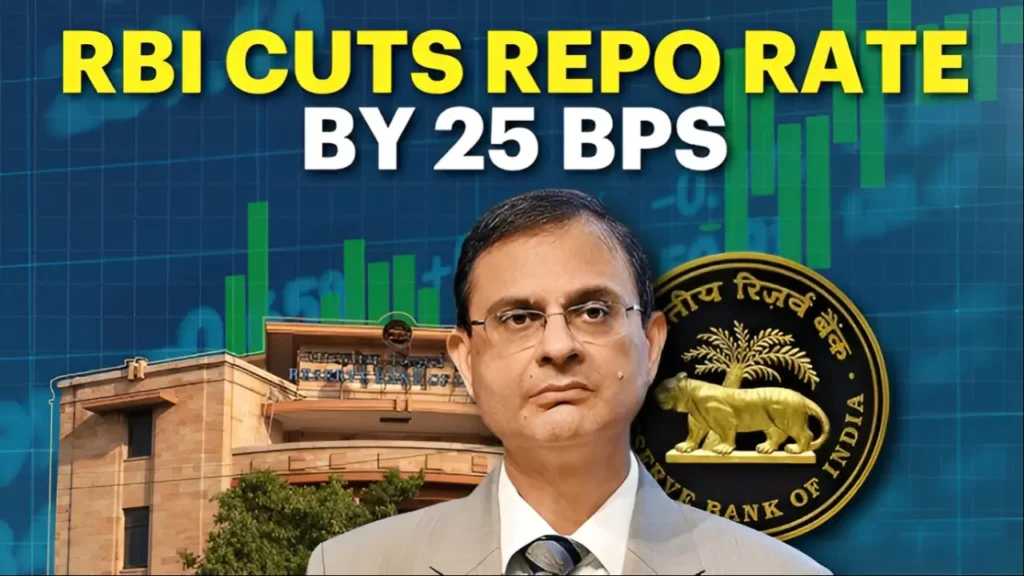

RBI’s Bold Move to Support Growth

On June 6, 2025, the Reserve Bank of India (RBI) made a significant policy shift by slashing the repo rate by 50 basis points to 5.5%. This move, marking the third consecutive rate cut of the year, aims to stimulate economic activity by making borrowing more affordable. The RBI also reduced the Cash Reserve Ratio (CRR) by 100 basis points to 3%, injecting approximately ₹2.5 lakh crore into the banking system to enhance liquidity and encourage lending.

Economic Context and Policy Shift

Governor Sanjay Malhotra highlighted that inflation has softened significantly over the past six months, falling from above the tolerance band in October 2024 to well below the target. This decline, coupled with slower-than-expected economic growth, prompted the RBI to adjust its monetary policy stance from “accommodative” to “neutral.” This change indicates a balanced approach, where future policy decisions will depend on incoming economic data, particularly concerning inflation and growth.

Impact on Borrowers and the Real Estate Market

The reduction in the repo rate is expected to lead to lower Equated Monthly Installments (EMIs) for borrowers with floating-rate loans. For instance, a ₹50 lakh home loan with a 20-year tenure could see a significant drop in EMI payments, resulting in substantial savings over the loan’s duration. This is particularly beneficial for first-time homebuyers and those seeking to refinance existing loans.

The real estate sector, especially affordable housing, stands to benefit from these changes. Developers anticipate a revival in demand for homes priced below ₹50 lakh, as lower interest rates improve affordability. This could lead to a turnaround in the market, with increased sales and accelerated project completions.

Stock Market Reaction and Investor Sentiment

The stock market responded positively to the RBI’s policy announcement. The BSE Sensex surged by 747 points, closing at 82,189, while the Nifty 50 rose by 0.94%. Sectors such as banking, real estate, and automobiles saw significant gains, reflecting investor optimism about increased liquidity and lower borrowing costs. The rally added approximately ₹3.6 lakh crore to investors’ wealth, pushing the total market capitalization to over ₹451 lakh crore.

Looking Ahead: Economic Projections and Risks

Despite the positive outlook, the RBI remains cautious. The central bank projects a GDP growth rate of 6.5% for the current fiscal year, down from 7.4% in the previous year. Inflation is expected to average 3.7% in FY26, with the first quarter seeing a rate of 3.6%. While the outlook is favourable, the RBI emphasizes the need to monitor global economic conditions, including trade tensions and commodity price fluctuations, which could impact domestic growth and inflation.

Conclusion

The RBI’s decision to cut the repo rate and adjust the CRR demonstrates a proactive approach to supporting economic growth amid a challenging global environment. For borrowers, this translates into lower EMIs and reduced interest costs, making loans more accessible. The real estate sector is poised for a resurgence, driven by improved affordability. While the stock market has reacted positively, the RBI’s neutral stance indicates a careful balancing act between fostering growth and maintaining economic stability. As the situation evolves, continued monitoring of economic indicators will be essential to navigate the path ahead.

Leave a Reply