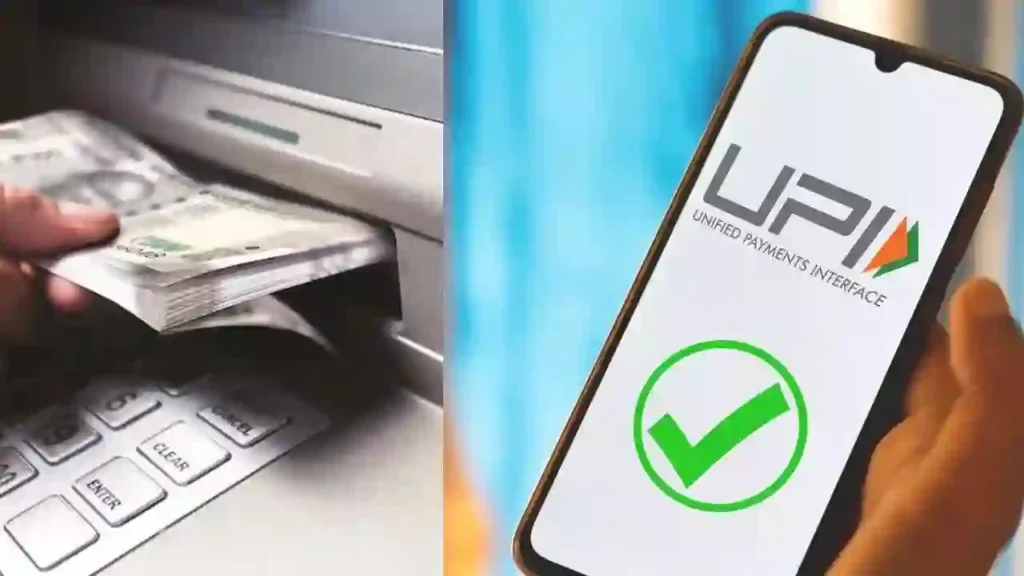

The Reserve Bank of India (RBI) has introduced a groundbreaking facility for Unified Payments Interface (UPI) users, allowing them to deposit cash through UPI at Automated Teller Machines (ATMs). This announcement was made by RBI Governor Shaktikanta Das during the release of the RBI Monetary Policy. Traditionally, cash deposit through Cash Deposit Machines (CDMs) has been restricted to the use of debit cards. The introduction of this facility is expected to redefine convenience for millions of UPI users, who can now deposit cash directly into their bank accounts using UPI at CDMs.

The RBI’s decision comes on the heels of the successful implementation of card-less cash withdrawals using UPI at ATMs. “The introduction of cash deposit via UPI at ATMs will not only boost customer convenience but also streamline the currency handling process across banks,” stated Governor Das.

In a move to further broaden the scope of digital transactions, Governor Das also announced that users will gain UPI access for Prepaid Payment Instruments (PPIs) through Third Party Apps. Currently, UPI payments from PPIs are restricted to the platforms provided by the PPI issuer. With this new proposal, users will have the flexibility to use any third-party UPI application to make payments from their PPI wallets. This initiative is expected to promote the adoption of digital payments for small-value transactions, thereby enhancing the overall digital payment ecosystem in India.

These measures, aimed at enhancing customer convenience and encouraging digital transactions, are anticipated to have a significant impact on the banking sector and its customers.

Leave a Reply