In today’s digital age, accessing your e-PAN card has never been easier. The e-PAN card, a digital counterpart of the Permanent Account Number (PAN) card issued by the Income Tax Department of India, can now be obtained online through the UTI Infrastructure Technology and Services Limited (UTIITSL) website. This guide will walk you through the process of downloading your e-PAN card step by step:

Eligibility Criteria for e-PAN Download:

- This service is available to individuals who have applied for a new PAN or requested an update for any changes or corrections via UTIITSL.

- Applicants must have a registered and verified mobile number or email address linked to their PAN details in the Income Tax Department’s database.

Downloading Your e-PAN Card: For those eligible, UTIITSL provides a complimentary download of the e-PAN in PDF format if issued in the last month, applicable for both new PAN applications and change/correction requests. Should you need to download your e-PAN after this period, a nominal fee of Rs.8.26 (tax inclusive) is charged for each download.

Important Information:

- A download link for the e-PAN will be sent to your registered mobile number via SMS and/or to your email. Use the OTP received to download your e-PAN.

- If your contact details are not registered, you’ll need to submit a change or correction request to utilize the e-PAN download feature.

- You have up to three attempts to download your e-PAN via the provided link, which remains active for one month, at no additional cost.

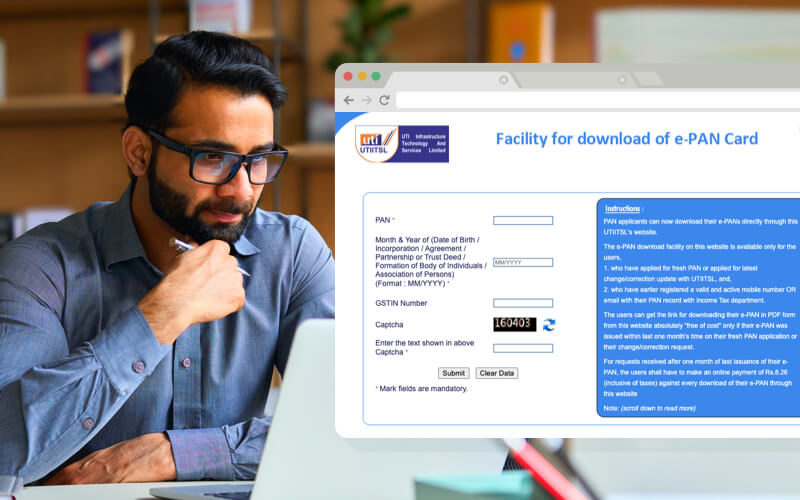

Step-by-Step Guide to Download e-PAN from UTIITSL:

- Select ‘Download e-PAN card (For PAN allotted older or more than in last 30 days).’

- Enter your PAN, birth month, and year.

- Click ‘Submit’ to generate and download your e-PAN card.

Following these straightforward steps will ensure you have easy access to your e-PAN card, reflecting the convenience and efficiency of digital governance initiatives by the Income Tax Department and UTIITSL.

Leave a Reply