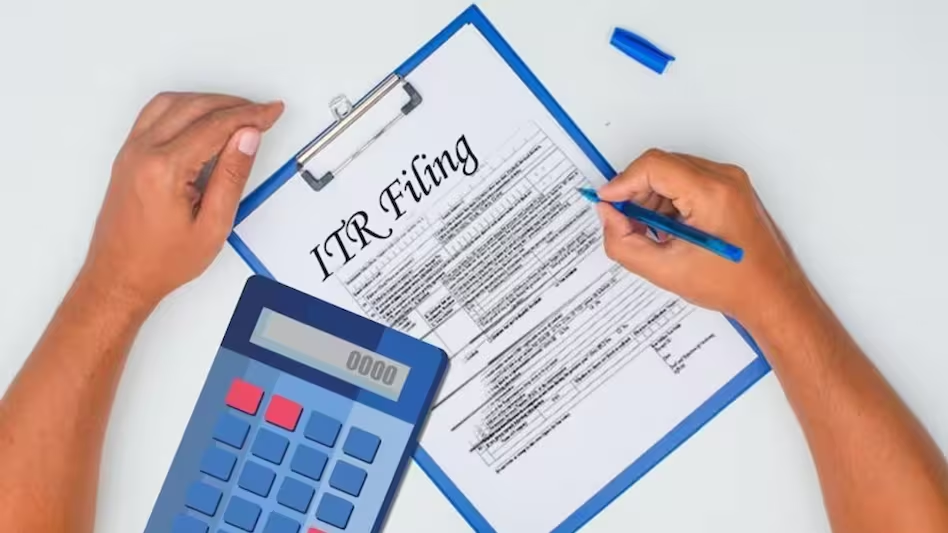

- The last date for filing Income Tax Returns (ITR) for FY 2023-24 is July 31.

- If missed, you can file a belated return by December 31, but there are penalties and consequences.

- Missing the deadline means an automatic shift to the new tax regime and potential loss of benefits.

What Are the Consequences of Missing the July 31 Deadline?

If you miss the July 31 deadline for filing your Income Tax Return (ITR) for the financial year 2023-24, several important repercussions can impact your financial situation. Here’s what you need to know:

1. Filing a Belated Return: You still have a chance to file your return after the deadline. The Income Tax Department allows taxpayers to submit a belated return by December 31 of the same year. However, this comes with certain penalties and limitations.

2. Late Filing Fees: According to Section 234F of the Income Tax Act, if you file your ITR after July 31 but before December 31, you will be charged a late filing fee. The fee is ₹5,000, but if your total income does not exceed ₹5 lakh, the penalty is reduced to ₹1,000. This fee is in addition to any taxes owed.

3. Interest on Outstanding Tax: In addition to the late filing fee, you will also be liable to pay interest on any outstanding tax amount. This interest is calculated at the rate of 1% per month or part of the month from the due date until the date of filing. However, the total penalty imposed cannot exceed the amount of tax due.

4. Automatic Shift to New Tax Regime: India currently operates two tax regimes: the old regime with its existing tax slabs and deductions, and the new regime introduced in 2020 with revised tax rates and fewer deductions. If you miss the ITR filing deadline and do not file a belated return by December 31, you will be automatically shifted to the new tax regime, which is the default option. This could mean losing out on the benefits and deductions available under the old regime.

5. Loss of Carry Forward of Losses: Filing your ITR late also means losing the opportunity to carry forward any capital losses incurred during the financial year. These losses, which could otherwise be used to offset future gains and reduce tax liability, will not be carried forward if the return is filed after the due date.

6. Speculations About Deadline Extension: There are occasional speculations that the government might extend the ITR filing deadline. However, it’s risky to rely on these speculations. For instance, in 2023, many taxpayers were caught off guard when the deadline was not extended. To avoid unexpected penalties and complications, it’s advisable to prepare and file your returns well before the deadline.

Conclusion

Missing the July 31 deadline for filing your ITR can lead to significant penalties, interest on unpaid taxes, and other financial drawbacks. While you can file a belated return by December 31, it’s crucial to be aware of the additional costs and potential loss of benefits. The safest approach is to file your ITR on time, ensuring you avoid any unnecessary complications and maintain control over your tax benefits and financial planning.

Leave a Reply