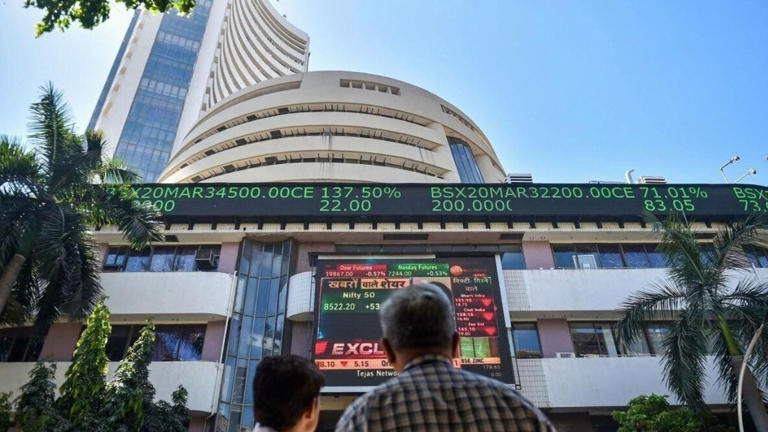

- The Sensex surged over 500 points, continuing its five-day winning streak.

- Foreign investors are reducing their selling pressure, bringing stability to the market.

- Large-cap stocks are attracting buyers, boosting investor confidence.

What’s Driving This Market Rally?

The stock market is showing strong momentum, with the Sensex rising over 500 points and the Nifty50 gaining more than 150 points. The rally is being driven by two major factors: a slowdown in foreign investor selling and attractive valuations of large-cap stocks.

Foreign investors (FIIs) had been aggressively selling Indian stocks for months, causing market fluctuations and eroding over ₹2.4 lakh crore in market capitalization since October. However, recent data suggests that FIIs are now buying in the cash market and shifting to long positions in the futures market, signaling a potential reversal. This shift has given confidence to retail investors, leading to a rebound in mid-cap and small-cap stocks.

Will the Rally Continue?

While the current rally is fueled by strong domestic buying and reduced FII outflows, experts warn that global trade tensions could pose risks. Former US President Donald Trump’s proposed reciprocal tariffs are set to take effect on April 2, which could impact certain sectors of the market. However, domestic consumption-driven stocks remain resilient and continue to see gains.

Investors are optimistic, but many are waiting to see how the global trade situation unfolds before making further investment decisions. For now, the Indian stock market is riding a wave of positive momentum, with hopes of a sustained rally ahead.

Leave a Reply