- The US has announced a 25% tariff on imported cars and auto components.

- Indian companies like Tata Motors, Eicher Motors, and Samvardhana Motherson could face financial strain.

- Prices of popular vehicles like Jaguar Land Rover (JLR) and Royal Enfield motorcycles may rise in the US market.

Will Indian Auto Companies Take a Hit?

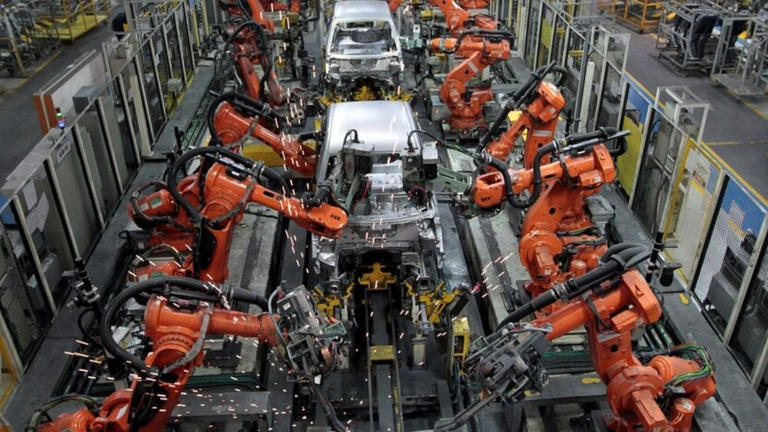

US President Donald Trump’s decision to impose a 25% tariff on imported cars has sent shockwaves through the global auto industry. While this move is primarily directed at countries like Japan, South Korea, and China, Indian companies may also suffer indirect consequences.

Tata Motors, which owns Jaguar Land Rover (JLR), could feel the heat. JLR heavily depends on the US market, with 22% of its global sales coming from America. Since JLR vehicles are mostly manufactured in the UK and other overseas factories, the new tariff will make these cars significantly more expensive for American buyers. If prices rise, JLR’s sales could take a major hit, ultimately impacting Tata Motors.

Eicher Motors, the parent company of Royal Enfield, is another company that could be affected. Royal Enfield’s 650cc motorcycles have a strong customer base in the US, and the new tariffs might make them less affordable, potentially slowing down sales.

Auto component giant Samvardhana Motherson, which supplies parts to global carmakers like Tesla and Ford, may also face challenges. However, since the company has manufacturing units in Europe and the US, it could cushion the impact of the tariff to some extent.

Other Indian auto part makers like Bharat Forge, Sansera Engineering, Suprajit Engineering, and Balkrishna Industries also face risks. These companies export a large portion of their products to Europe and the US, meaning the new tariff could disrupt their business flow.

What’s Next for Indian Auto Companies?

The new tariff could force Indian auto companies to rethink their global strategies. Some might explore setting up manufacturing units within the US to avoid heavy import duties. Others might have to raise prices or find alternative markets to maintain their sales.

For now, Indian businesses are watching closely as they brace for potential economic speed bumps caused by Trump’s trade policies.

Leave a Reply